The future of buy now, pay later

The momentum behind recent growth of buy now, pay later (BNPL) activity shows no sign of flagging. More than 1 in 5 U.S. shoppers are expected to make a buy now, pay later (BNPL) purchase this year, and that ratio is projected to top 1 in 4 shoppers by 2025.

“Buy now, pay later is definitely not a fad; it’s here to stay,” said Andrew Lipsman, eMarketer Principal Analyst at Insider Intelligence. “It helps make purchases across all sorts of categories more digestible into people’s budgets.”

In this blog post we’ll explore what buy now, pay later is, why it’s gaining in popularity with consumers, and how it’s becoming a revenue and marketing accelerator for retailers.

Ready to try the buy now, pay later solution that delivers?

What is BNPL and how does it work?

Buy now, pay later is a payment method that many shoppers choose as an alternative to a credit card. Shoppers can use a BNPL provider like Affirm to buy an item immediately and commit to paying for it later in biweekly or monthly payments.

As a payment option, BNPL resembles the “layaway” concept that was popularized years ago by many department stores. In that model, shoppers would pay for an item in recurring installments and then take ownership of it once they paid the full amount.

To understand how a BNPL transaction works today, let’s consider a shopper, Peggy, who’s looking to buy an air purifier for her family room. After shopping around online, she finds one she wants at a (fictitious) site called Generic Air for $200. It’s more expensive than other models that fit her $125 budget, but the $200 model has the exact features she prefers.

The next steps show her journey to buying the item with flexible payments.

Peggy discovers the offer to pay over time. On the air purifier product page, she sees the $200 price tag alongside a message that the item could also be hers for 4 interest-free payments of $50. This 4-way split catches her interest, because paying $200 immediately doesn’t fit in her budget. But paying $50 every two weeks is more manageable. The pricing details also display a link to a BNPL service (in this case, Affirm) so she can apply to see if she’s eligible.

She clicks the link to apply. She then provides 4 quick pieces of information (name, birthdate, phone number, and email address). Affirm’s underwriting technology processes the data and notifies her of an approval decision within seconds.

Peggy buys the air purifier. At checkout she selects the Affirm payment option. She sees exactly what her payment schedule will be and agrees to it, completing the transaction. (In this example, she pays no interest. Other BNPL purchases may include interest and have longer terms for fixed monthly payments. Such transactions may also require collecting additional info.)

The store gets immediate payment. Generic Air is paid the full purchase price, minus the agreed-upon fee for Affirm. The contract with Affirm frees Generic Air from having to collect Peggy’s payments. And Peggy gets the air purifier she really wants.

Peggy pays Affirm. She makes her payments, in this case, every two weeks according to the schedule she agreed to. She knows exactly what she owes, and Affirm never charges hidden or late fees.

After completing the purchase, Peggy is glad she didn’t have to stretch beyond her budget for the air purifier she preferred. The process of buying with flexible payments was simple and convenient, and the experience reflects well on her overall impression of Generic Air. She’s more likely to shop there again or recommend it to friends.

The benefits for Generic Air include a sale with a price tag that might not have happened without the option of split payments. Her favorable impression of the buying process could also turn her into a repeat customer for Generic Air.

The increase in value achieved for both the customer and the business is a major part of BNPL’s appeal.

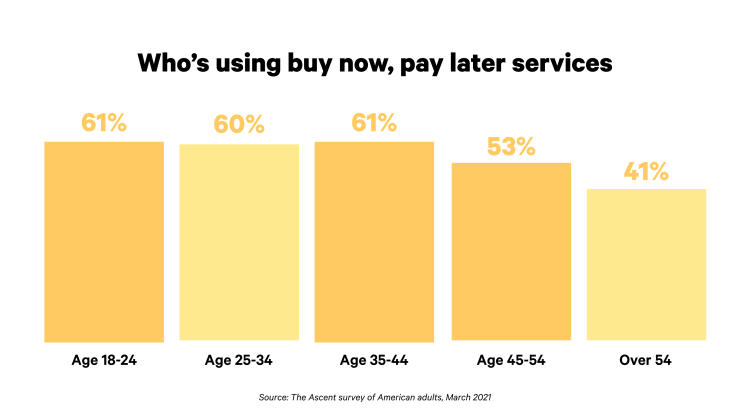

Who is using BNPL?

Buy now, pay later started to catch on with millennial shoppers as the U.S. economy was in the early stages of recovering from the Great Recession of 2008. The downturn’s hardships made a lasting impression on members of that generation—they saw family members struggle with job losses, mortgage defaults, and credit card debt. On top of that, many of these young consumers were burdened with their own student loans.

As BNPL emerged as an alternative to credit cards, many shoppers embraced it as a way to manage their personal cash flow. The transactions are easy to understand and are often interest-free. Today Gen X and millennial shoppers—the two largest demographics for spending potential—make up the majority of BNPL transactions.

With their spending power, these shoppers have high potential for becoming valuable long-term customers. Seven in 10 BNPL users make more than $75,000 per year, according to research by Cornerstone Advisors.

The economic toll of the global coronavirus pandemic sparked widespread adoption of buy now, pay later. That’s because pay-over-time options helped many people stretch their spending power. And BNPL is still doing that for many shoppers today.

Why do shoppers like BNPL?

Buy now, pay later is popular with shoppers for a number of reasons, including convenience, flexibility, and transparency. Shoppers can use BNPL apps on their phone or desktop. They can also shop with the apps in retail stores. Downloads of buy now, pay later apps increased 54% in November 2021 compared to the prior year.

Several surveys conducted in 2020 revealed other compelling factors that led consumers to choose BNPL. Research conducted by the Ascent—with 1,800 consumers who made purchases with BNPL services—listed these top reasons:

To make purchases that otherwise wouldn’t fit in my budget (45%)

To avoid paying credit card interest (37%)

To borrow money without a credit check (25%)

I don’t like to use credit cards (19%)

A research report from Shopify cited these top 3 reasons U.S. consumers used a BNPL option:

“It was easier on my budget to pay in smaller chunks.”

“I wanted to take advantage of a good deal now.”

“It’s better than a credit card because it’s interest-free.”

Since the height of the pandemic, the momentum toward flexible payments has continued to grow. In our recent survey, nearly two-thirds of respondents (65%) planned to use a BNPL option this year.

How is BNPL growing?

Today, buy now, pay later is one of the fastest-growing e-commerce payment methods. The global BNPL market size is expected to top $39 billion by 2030, with a compound annual growth rate of 26% between 2022 and 2030.

To capitalize on this trend, retailers of all sizes are partnering with BNPL providers to offer shoppers flexible payment options. By the end of March 2022, more than 207K merchants were offering pay-over-time options with Affirm—an increase of over 1600% from the prior year.

Most BNPL providers make it relatively easy to integrate the payment processing technology into an e-commerce site. If your business works with a major e-commerce platform like Shopify, the integration may be as simple as a few clicks.

With a low barrier for e-commerce integration and huge upside potential for sales volume, ignoring BNPL solutions could put your business at a competitive disadvantage.

Why BNPL is here to stay: merchant benefits

Many of the studies cited in this article show benefits retailers stand to gain by offering pay-over-time options to customers. These can include higher average order values (AOV) and conversion rates, along with lower cart abandonment and customer acquisition costs. The increased likelihood of repeat purchases and customer satisfaction can add more loyalty for your brand. In addition, 60% of shoppers think more favorably of brands that offer a pay-over-time option.

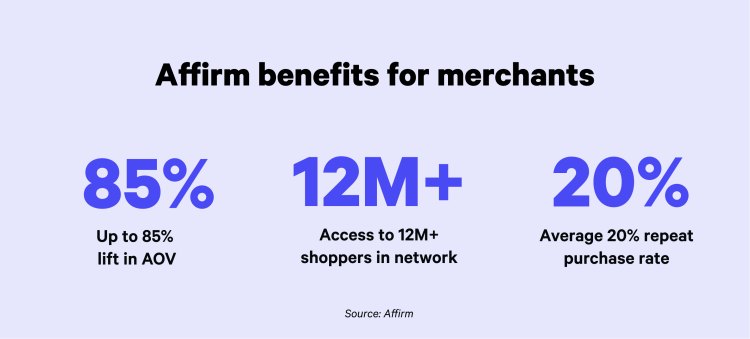

For merchants that partner with Affirm to offer buy now, pay later options to customers, the benefits include:

Up to 85% higher AOV

Access to 12+ million shoppers in our network

20% repeat purchase rate with Affirm users

The versatility of Affirm’s buy now, pay later solution makes sense for all price points: Flexible terms are based on cart size or item value. Shoppers can select 4 biweekly interest-free payments on smaller purchases, or monthly installments (spanning 3 months up to 36, with or without interest) on more expensive buys.

We’ve seen a wide variety of businesses—like travel providers, luxury brands, department stores, electronics retailers, and auto service centers—profit by partnering with Affirm.

“Using our A/B testing platform we’ve proven that we're getting incremental new customers who wouldn't have booked with us if we didn't offer Affirm,” said Jacobus Kok, Product Director at Priceline. “So that's the biggest benefit—growth in the business.”

“It also helps with customer satisfaction,” said Luan Nuriu, Service Director of Audi Coral Springs. “When people see what we’ve been able to do for their car and then offer them a flexible way to pay, they think we’re heroes!”

The pace of e-commerce growth is rapidly accelerating—and BNPL’s popularity, convenience, and flexibility are fueling much of it. What better time to get on board so you don’t miss out?

Learn how Affirm can increase sales for your business with our free ebook, Pay-over-time pays off.