WHAT IS AFFIRM?

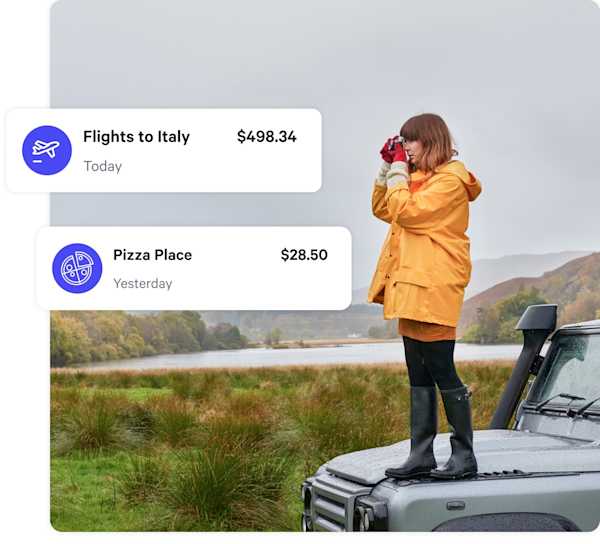

Life on your terms

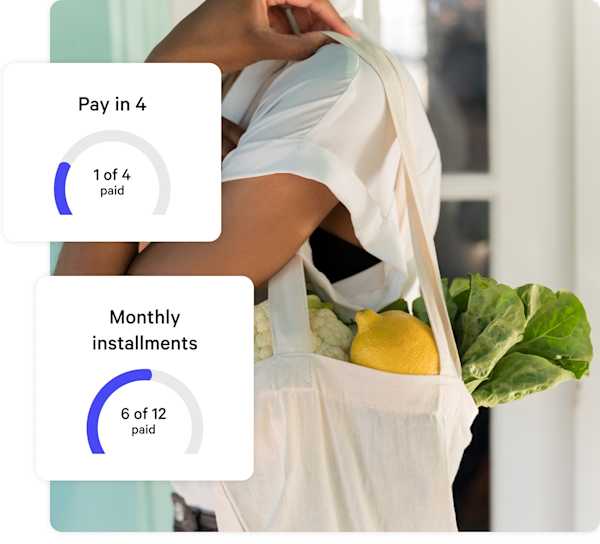

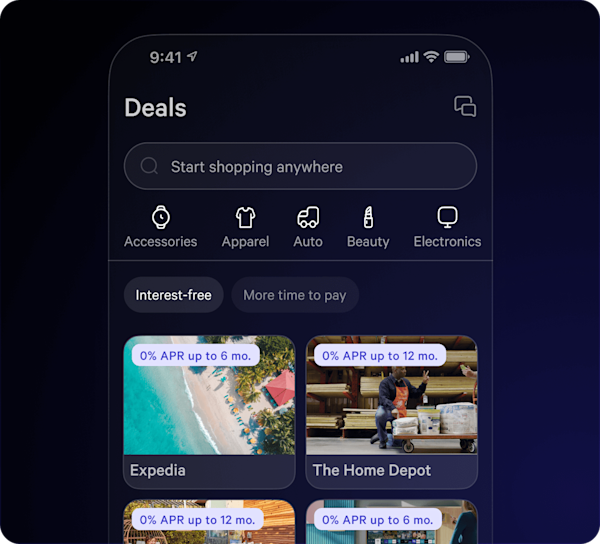

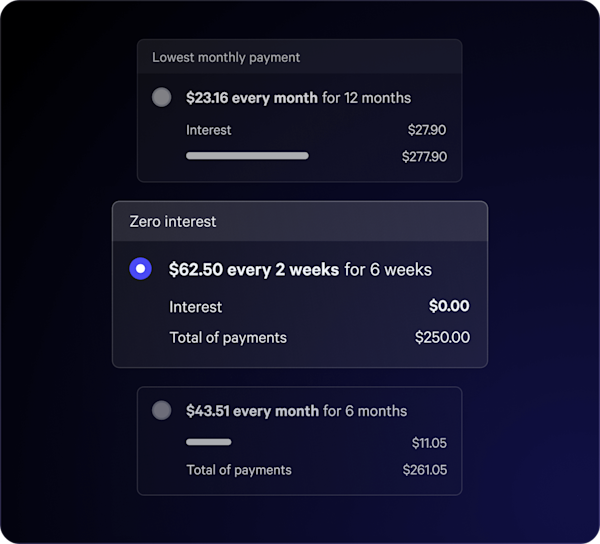

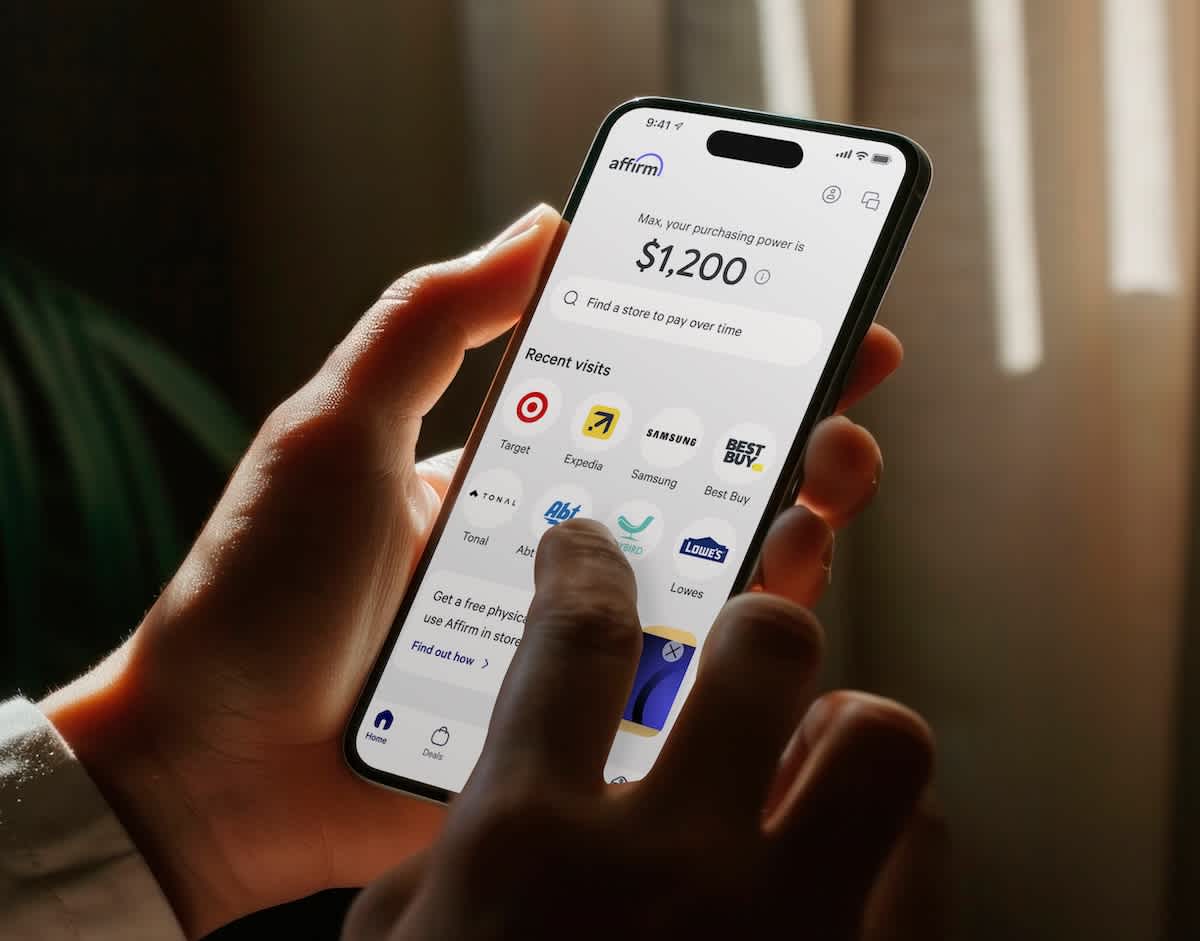

With Affirm, you can buy now and pay later at your favorite brands. We never charge hidden fees or compound interest. Just take us wherever you want to shop for the best way to pay for the things you need.

Okay, so how do we make money?

We earn a commission from businesses, and shoppers pay interest on some items.

Unlike credit card companies though, we don't depend on shoppers paying late or staying in debt. Instead, we try to give them a great experience so they come back and use Affirm again.

Reasons you’ll love Affirm

Need more info?

We’ve got you.