Why Affirm is essential to your customer acquisition strategy

New customers are the growth engine of nearly every business today. But the range of tools and costly tactics for acquiring those customers presents a complex challenge. Thankfully, partnering with Affirm can simplify and enhance customer acquisition for your business.

Affirm provides what many shoppers seek today: the flexibility to buy what they want and make fixed payments over time. Also known as buy now, pay later (BNPL), this option is the world’s fastest growing e-commerce payment method. In 2020, BNPL accounted for $24 billion in U.S. spending.

Here are 5 ways Affirm helps you attract and win new customers.

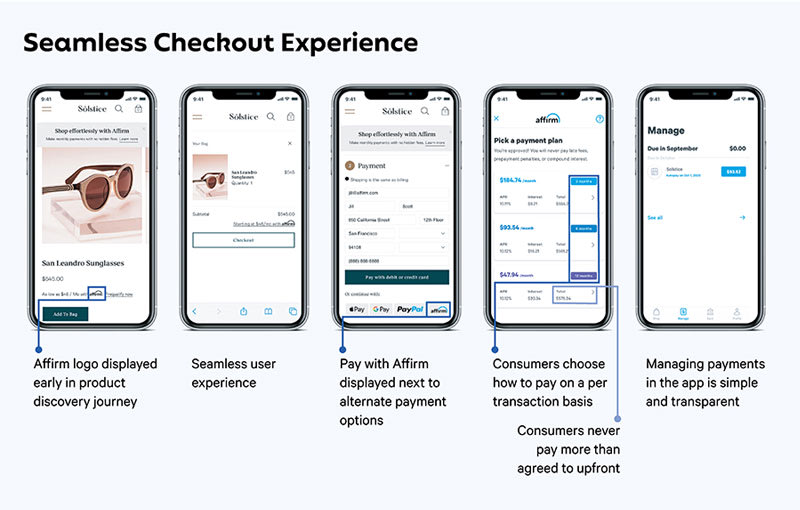

1. Integrate Affirm into your checkout flow

Shoppers dislike friction at checkout—be it multiple screens, slow loading, or not seeing a preferred payment option. This often results in a high rate of abandoned carts: a big frustration for e-commerce businesses.

Fortunately, adding a BNPL option to your checkout helps reduce that friction. Since 2013, Affirm’s seamless checkout experience has made it easy for shoppers to buy what they want and pay at their own pace. Integrating Affirm into your checkout is easy, too. It requires minimal development work and displays pay-over-time options right alongside your existing payment offerings.

Ready to try the buy now, pay later solution that delivers?

Our BNPL solution also removes price as a barrier for shoppers. When they have the flexibility to split their purchase into fixed payments over time, it’s easier for them to say yes to their purchase—and to becoming your customer.

BB Wheels made the decision to integrate Affirm into its site as a way to grow its customer base, and the result helped bring a 92% increase in daily sales volume.

The integration with Affirm has delivered similar benefits to a wide variety of businesses. “We’ve proven using our A/B testing platform that we're getting incremental new customers who wouldn't have booked with us if we didn't offer Affirm,” said Jacobus Kok, Director of Product for Priceline. “So that's the biggest benefit—growth in the business.”

In short, integrating Affirm into your checkout flow is a great way to reduce customer acquisition costs by preventing the loss of high-intent shoppers.

2. Promote your brand in the Affirm shopping app

Affirm can also help you attract customers who haven’t ever visited your website. Our app has more than 6 million potential customers ready to discover your brand.

The Affirm app’s personalized shopping experience highlights merchants that align with each shopper’s preferences, giving you a way to reach potential customers in a more targeted fashion. Shoppers can browse by product category or life event, and they can discover your brand using the search function.

The shoppers in our growing network are likely to convert at a higher rate. That’s because they come to us looking for great deals, and we provide them with the spending power—in the form of biweekly or monthly payments—to make those purchases.

Shoppers can also find compelling promotions like 0% APR offers that may fit their budget better. This is another marketing lever you can use to amplify your exposure to new customers who love to shop with Affirm. You can also promote your brand in the app without having the Affirm integration in your site’s checkout.

Here’s how one user described the app in an online review: “Easy to use, and before you shop they tell you how much you’re pre-approved to spend. Would use again and again!”

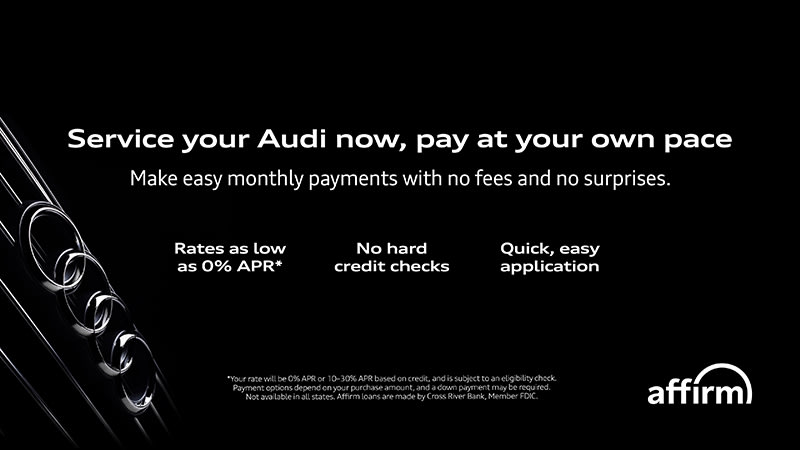

3. Highlight Affirm in marketing and social media campaigns

You can also leverage existing marketing efforts to attract new customers by letting them know they can buy with Affirm at your store or on your site. It can be as simple as adding zero-interest offers in your ads or placing a banner on your website, as this Audi service dealer did.

Results demonstrate these placements can be very effective in leveraging Affirm as an acquisition tool in your overall marketing strategy.

Chrono24, the largest luxury watch marketplace in the world, added Affirm messaging in emails and in a social media campaign. In addition to a 38% lift in Affirm sales volume, the campaign expanded Chrono24’s customer base, particularly with millennials and Gen Z buyers.

Shoe retailer Paul Evans saw similar results after including details about Affirm in social media marketing. CEO John Scrofano called Affirm “a powerful point of differentiation from our competitors that we could use to engage existing and prospective customers.”

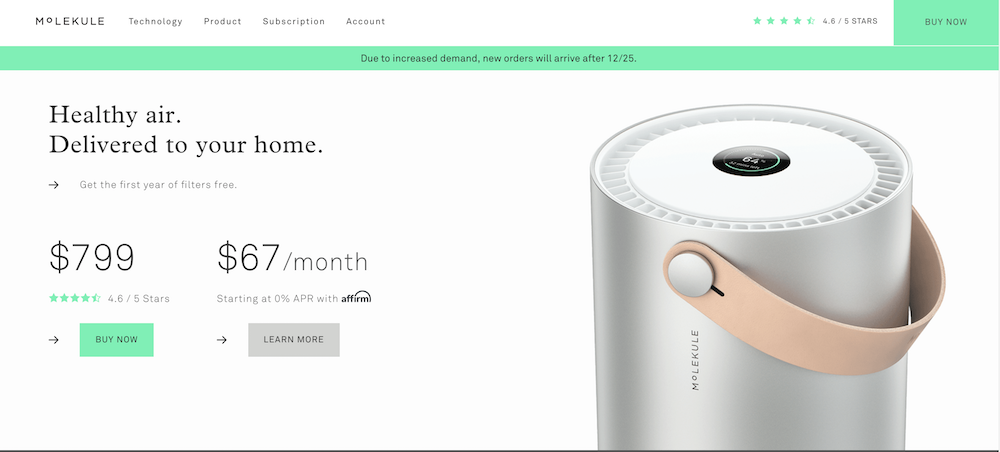

4. Promote pay-over-time early in the customer journey

Here’s another way to turn browsers into new customers: Let them know they can buy now, pay later with Affirm well before they get to checkout. Whether through in-store signage or as low as messaging on product display pages, you’ll raise awareness among shoppers early on about the options to split the purchase price into smaller increments over time.

“The integration on the product pages was a piece of cake,” said Josh South, Director of Marketing and Technology at SuperATV. His business saw “tremendous growth” after that, including a 333% increase in Affirm sales volume.

Molekule acquired new customers with a similar tactic on its product pages. “People see our product, and they assume it’s expensive,” said Ruth Duggan, Senior Marketing Manager at Molekule. “But when they see they can buy it for $67 a month, it’s a lot more manageable.”

5. Broaden your customer base with more approvals

As the examples above show, integrating Affirm into your checkout flow and marketing pay-over-time to shoppers can expand your customer base. But there’s another advantage that can help your acquisition strategy: Affirm approves 20% more customers than competitors.

Mattress retailer iSense recently switched from Klarna to Affirm and discovered an immediate difference in the first month. “More customers were being approved, and sales started coming through via Affirm,” said Paul Longman, CEO of iSense. “We saw those sales go up by a factor of five.”

After Ghostbed switched from Klarna, they implemented our increased approvals program to attract even more new customers. The result was a 30-40% jump in approvals compared to Klarna.

“Partnering with Affirm can unlock business value by opening up or expanding market segments,” said Priceline’s Jacobus Kok. “It’s been interesting to see our demographic performance with Affirm, especially their strength in the millennial and Gen Z markets.”

Your strategy for acquiring customers doesn’t have to involve expensive demographic research and targeting. Nor does it need to require heavy discounting. Partnering with Affirm can support your customer acquisition strategy in five distinct ways to become one of your most powerful marketing tools for growth.

Learn more how Affirm can boost customer acquisition and sales for your business. To feature your brand in the Affirm app, email affiliate@affirm.com.

Payment options through Affirm are subject to an eligibility check, and are provided by these lending partners: affirm.com/lenders. CA residents: Loans by Affirm Loan Services, LLC are made or arranged pursuant to California Finance Lender license 60DBO-111681.