How Affirm is different: Understanding the fundamentals of credit

Despite the ubiquity of credit, few consumers know enough about its complex terminology and cost structure to make fully informed decisions. And most credit providers take advantage, charging a constellation of fees in order to maximize profits. The result is that in 2016 alone, American consumers paid more than $90 billion in fees.

At Affirm, we believe consumers should be able to benefit from a more honest and transparent form of credit. We quote customers a fixed price for their credit up front, so that when they sign up for a loan, they know exactly what they will end up paying. No matter what happens after they confirm their loan, they’ll never owe us a penny more than the amount they initially chose.

This FAQ is designed to clarify some of the subtleties around credit (including interest), how it affects consumers, and how Affirm is different.

Ready to try the buy now, pay later solution that delivers?

What is APR?

Let’s start with the basics. When applying for and using a credit card, consumers typically pay attention to one number: Annual Percentage Rate or APR. The Truth in Lending act requires lenders, by law, to express interest on an annual basis—hence, APR. The purpose of expressing an APR is to offer customers an easy way to compare credit products.

But it’s not that straightforward

Lenders must express interest on an annual basis, but that’s not necessarily how interest is calculated and charged. Interest on loans via Affirm, like most credit cards, actually accrues on a daily basis.

Some experts believe APR can be misleading in relation to short-term credit products, like credit cards. For one, most credit cards offer variable APR rates, meaning they will fluctuate according to the market, an index, or the U.S. prime rate. Second, the daily percentage rate could change depending on a number of factors including the current principal balance and potential fees, like late fees or a yearly fee. And most credit card fees—on average, six, but as high as twelve per card—are never part of the APR calculation.

These are just a few of the reasons why calculating the actual cost of a purchase made on a credit card can be difficult for the everyday consumer. And most credit card issuers don’t offer any of this information to consumers—they must figure it out themselves.

So, how is Affirm different?

While Affirm does express interest rates in terms of APR—as required by law—we differ in four major ways:

Simplicity: Our user experience is mobile optimized and only asks users for five pieces of information to make a credit decision.

Transparency: Affirm shows consumers up front—before even accepting the loan—what the total purchase cost will be, including the total interest amount.

Predictability: Affirm doesn’t charge any late, penalty, or annual fees which could add to the principal balance, and therefore complicate interest costs.

Control: Unlike credit cards, Affirm’s app and point-of-sale loans are not a revolving line of credit. Instead, we approve customers only for the amount they’re looking to purchase—on their terms. They can select to pay over 3, 6, or 12 months. And there’s no penalty for paying it off early.

Credit cards, on the other hand, can be confusing and complex when determining interest and total cost on a single purchase. Especially if it charges compounding interest.

Wait, what’s compounding interest?

Most credit cards charge compounding interest, or interest on interest. More specifically, compounding interest is interest charged not only on the principal balance but also on interest or some fees that have already accumulated.

Affirm doesn’t do that?

No. Interest on loans through Affirm are only charged interest on the purchase amount—or, principal balance. It’s why we can be transparent about the total cost at the time of credit approval, even before the user accepts it. And because we never charge any late or penalty fees, that amount will never change. Ever.

It’s also important to understand the effective interest

As stated above, expressing an interest rate for a credit product via an annual rate (APR) does not tell the whole story.

That’s why it’s important to understand what the effective interest rate is on a purchase. Basically, it is the interest rate that is actually paid over a given time period on a loan or credit product.

For example, if someone chooses to pay for a purchase with Affirm over a six-month term at 20% APR, the effective interest they will pay on that purchase will not exceed 5.91%.

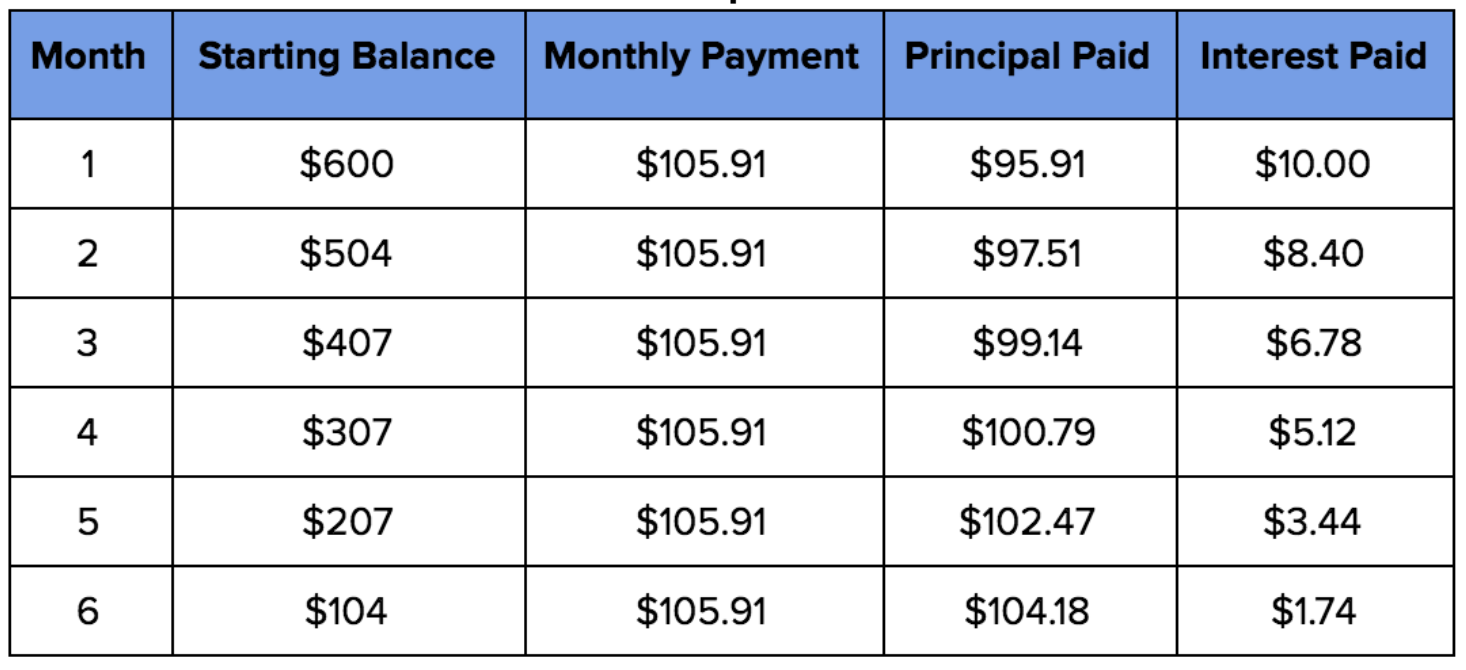

Here’s how it works. Someone applies, and is approved, for a $600 purchase with Affirm. The total payment amount for each month is $105.91. The total interest on the $600 is $35.48, or 5.91%.

This is the breakdown of how that monthly payment is going towards the principal balance as well as the interest:

If this person pays according to schedule, this is the amount of interest they would pay as a percentage of the original amount borrowed. If they decide to pay early, then they would pay less in total interest costs.

What about Affirm’s 0% APR promotion? Credit cards offer that all the time.

Actually, most 0% APR promotions offered by other credit cards—typically store-branded cards—are deferred interest promotions.

Most of these offers are 0% APR for 12 months, meaning that no interest will be applied to any purchases made within that time frame. The catch, however, is that if any balance remains after those 12 months—even just $1—or no payment has been made in 60 days, interest will not only be charged on the remaining balance but also on the full original balance. This doesn’t include any penalty or late fees that could also be applied.

Affirm’s 0% APR promotions, on the other hand, will never include deferred interest or penalty fees of any kind. Users can just select their term length—3, 6, or 12 months—and are shown the full amount owed for each month and in total. The selected amount will never change, no matter what.

Affirm loans are made by Cross River Bank, a New Jersey State Chartered Commercial Bank, Member FDIC.

Resources:

https://www.consumerfinance.gov