The Affirm app: Designed with shopping in mind

Affirm helps your customers say yes to more of the things they love. Our mobile app is one way we’ve been delivering on that mission.

Since launching the app in 2015, we’ve learned more about how our customers interact with the app and updated it to match their habits. The latest refinements to our app include:

Populating our app with offers that help customers find their next wishlist items in a way that fits their budget.

Allowing customers to pay over time at any store.

Making repayment straightforward so customers have a great experience that builds trust.

Each feature of our app has been designed with user experience, transparency, and retailer discovery in mind. We want to make the app the one-stop shop for finding new products, getting approved for loans, and keeping track of payments. Below is a walk-through of each part of the Affirm app.

1. Discovering new brands and the best deals with Affirm Offers

Affirm Offers is a retailer discovery experience to help the nearly 3 million shoppers in Affirm’s network find their next purchase. By giving premium placement for any retailer that offers a promotion, we display the best deals to our customers. Affirm Offers serves up relevant options in a curated shopping experience that maximizes cross-sell and awareness for participating retailers.

Some retail partners have reported up to 207% more sales volume and a 34% increase in average order value by participating in Affirm Offers.

Reach out to affiliate@affirm.com if you would like to take part in Affirm Offers.

2. Getting approved for a loan to use anywhere with a virtual card

We do everything in our power to serve our customers’ needs. Part of that goal is offering a way for shoppers to pay over time at retailers who haven’t integrated Affirm into their checkout flow.

The process starts with our Prequalification feature in the app. Shoppers can prequalify for credit after sharing five quick details, so they know exactly how much they’re approved to purchase with Affirm before the shopping journey even begins. Once they choose an item, shoppers enter the amount of their purchase, including tax and shipping, and select their repayment terms. We give users the flexibility to choose a payment term, either 3, 6, or 12 months, that works for their budgets. (For example, 12 payments of $83.33 for a purchase of $1000 with a 0% APR.)

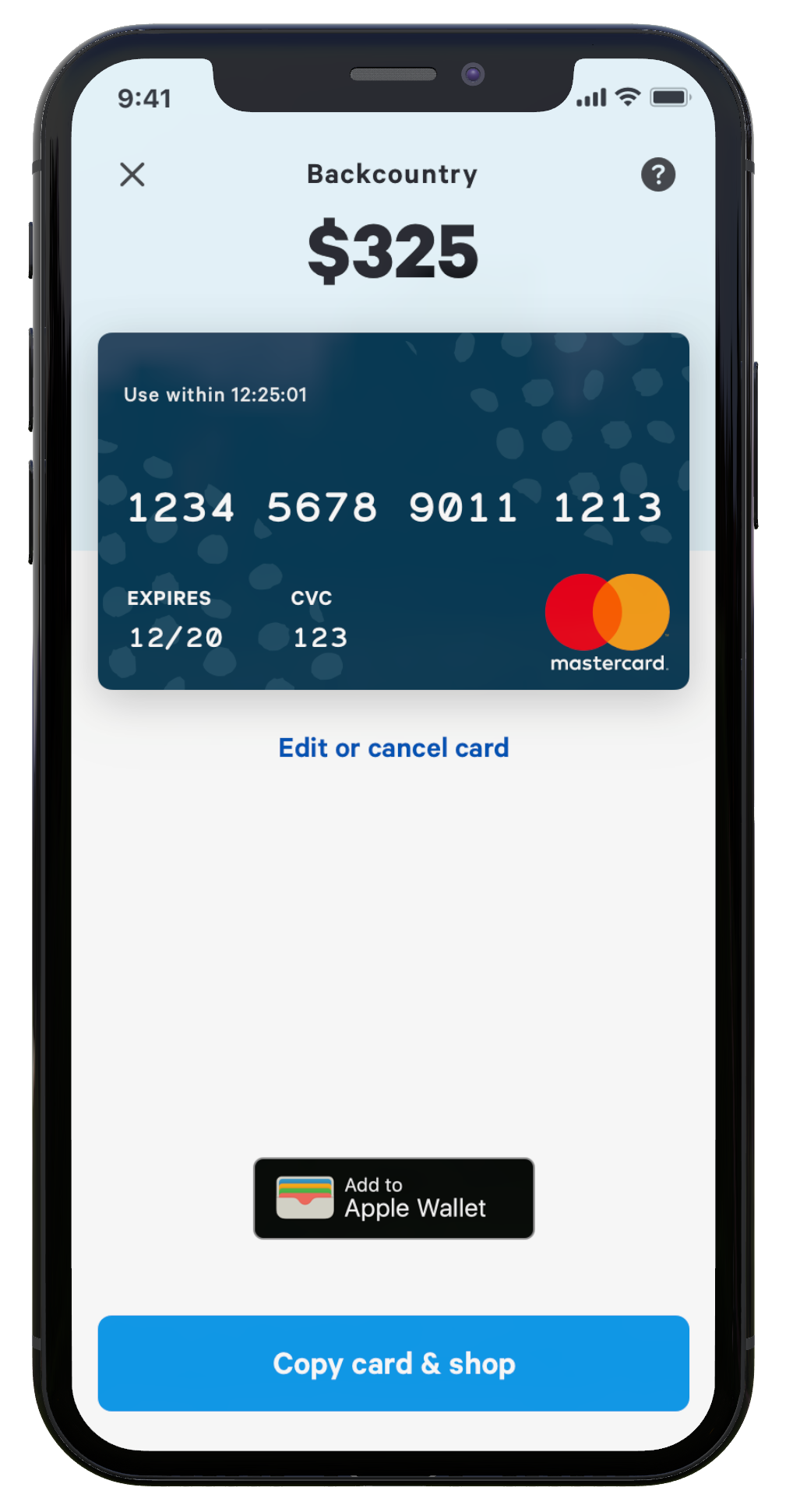

After Affirm displays the total interest payment up front, the customer accepts the loan. Then a virtual card is created in the app for the shopper to input into any checkout flow as a traditional credit card number.

The virtual card can also be added to Apple Pay or Google Pay and used in-store. The app becomes a driver for in-store purchasing by giving shoppers the benefits of Affirm’s pay-over-time options in any shopping channel.

3. Managing and repaying loans conveniently

We want to make it simple to get, track, and pay off an Affirm loan. This ease of use can also encourage shoppers to plan their next purchases as their repayment progresses.

Customers can track their loan payment dates and complete payment right on the app. We also make it obvious when a payment is due, and to encourage timely repayment. This task appears first in the queue whenever a customer enters the app. We have designed the experience to make paying off a loan as comfortable and quick as checking a text message. The security and satisfaction of completing the process can motivate customers to make another purchase with Affirm.

The app is designed to serve the needs of both our retail partners and customers. It was thoughtfully designed to make it easy for customers to find you and buy what they want in ways that fit their budgets. It’s a win-win-win for all of us.