Why shoppers love pay-over-time and hate late fees

Our spring survey on personal finances highlighted two clear preferences among American shoppers: They want to pay over time, and they hate late fees.

The survey—conducted with over 2,000 Americans in March 2021—also looked at topics related to personal income taxes. Of the respondents who expected to get a tax refund, more than half (54%) said they’re interested in spending it using a pay-over-time option like Affirm. Top categories for those intended purchases are clothing and accessories (52%) and travel (46%).

Interest in pay-over-time remains high

The desire to use pay-over-time for purchases this year is even higher (57%) among all respondents, and it’s consistent with spending plans revealed in our New Year’s survey. In fact, this flexible way of making purchases—also known as buy now, pay later (BNPL)—is expected to double in volume by 2024.

Ready to try the buy now, pay later solution that delivers?

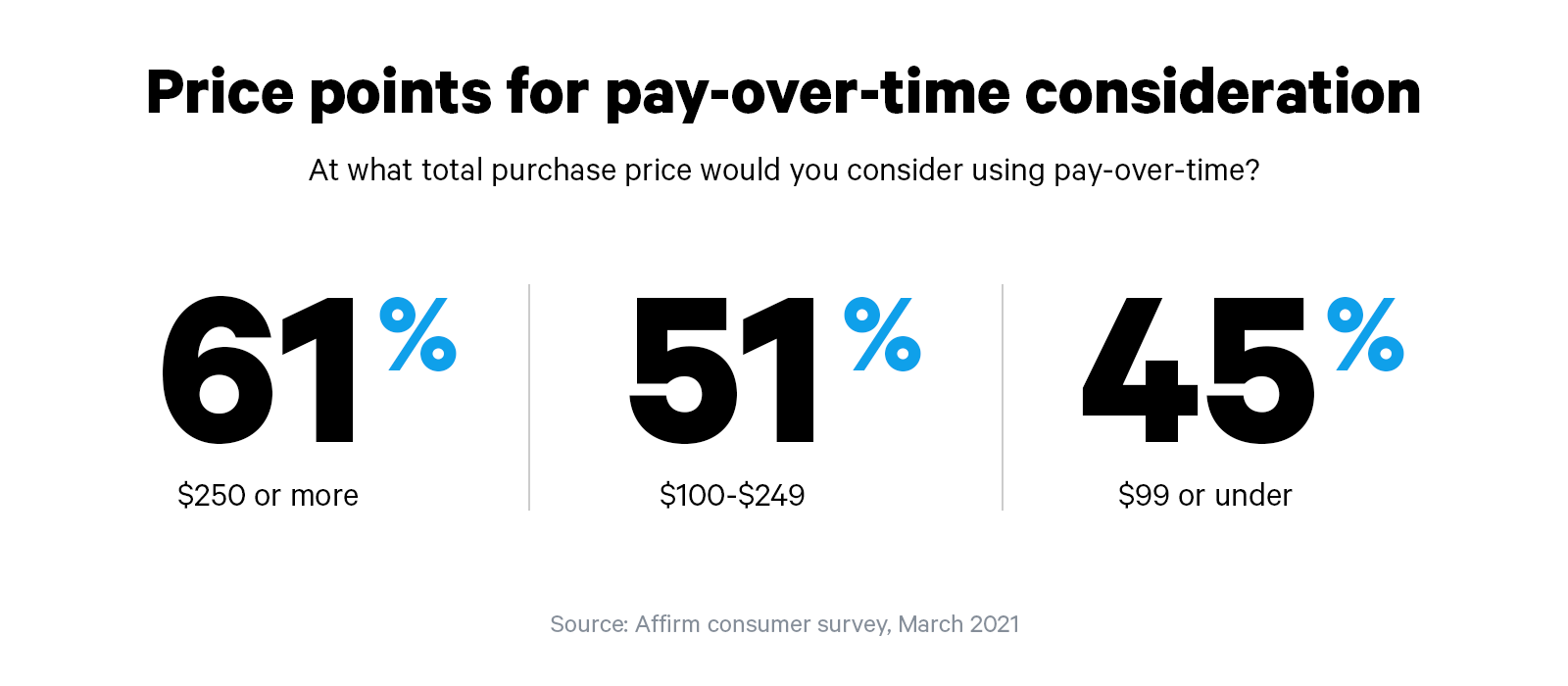

Respondents were asked about price points that would trigger their interest in paying over time. The majority (61%) said they were more likely to consider it if the total purchase price was $250 or higher. About half (51%) would use BNPL in a price range between $100 and $249, and 45% would consider it for purchases below $99.

Budget concerns and avoiding credit problems were also factors. The top 3 reasons people selected for wanting to use pay-over-time for purchases this year are:

To help keep me on budget (even if I can afford it right now) – 49%

To boost affordability (Item I want is expensive, and I can’t afford to pay in full) – 42%

To avoid using a credit card and help my credit score – 40%

There’s nothing worse than a late fee

Our research also looked at financial surprises, like a tax refund or a fee. In the latter category, late fees were the primary object of scorn. Nearly 3 in 4 respondents (74%) said there’s nothing worse than getting a late fee when paying a bill.

And 3 out of 5 people agreed with this statement: “Having to pay a late fee ruins my day.”

Late fees can ruin more than just your day. They cost the average household $132 per year, adding to debt and lowering credit scores. That’s why Affirm never charges late or hidden fees, and CEO Max Levchin has urged the financial services industry to say no to late fees.

Affirm is about helping shoppers say yes to more of what they want, while driving more sales and more customers to our merchant partners. Learn more about how Affirm can drive more sales for your business.

See more results of our consumer survey.