Republic Wireless finds success with Affirm

Goal: Offer customers a simple way to pay over time that’s also built on honesty and transparency

Republic Wireless is a pioneering wireless carrier based in Raleigh, North Carolina. A WiFi-first approach to mobile enables them to offer unlimited talk, text, and data plans from as low as $15/mo. Thanks to this unique approach, Republic was selected as one of the top three wireless carriers by PC Magazine’s Readers’ Choice Awards in both 2015 and 2016.

Republic’s customers tend to be budget-conscious and tech-savvy. As such, Republic currently accepts 12 mobile phone models through their BYOP (bring your own phone) option, requiring only the purchase of a $5 SIM card. BYOP is a great option for customers who already have a compatible phone, but many choose to purchase a new phone directly from Republic.

That’s where Affirm comes in. It’s no surprise that not everyone has the cash on hand to pay full price for a phone up front. “Four or five years ago, the majority of wireless customers were buying subsidized phones from our respective carriers, whether or not they knew it,” said Garett Vail, VP of product management at Republic. “That’s all changed, and now customer financing is the norm. All the big carriers offer and heavily market financing to consumers who either can’t or don’t want to pay for their phones outright.”

As a young startup in 2011, however, Republic didn’t meet traditional lenders’ requirements for financing programs. “It was honestly disheartening—some of the traditional lenders wouldn’t even talk to us,” said Vail.

Affirm and Republic leverage technology, innovation, and transparency

“And when we sought out the new generation of fintech lenders, we didn’t like their aggressive APRs or their required short-term lengths.”

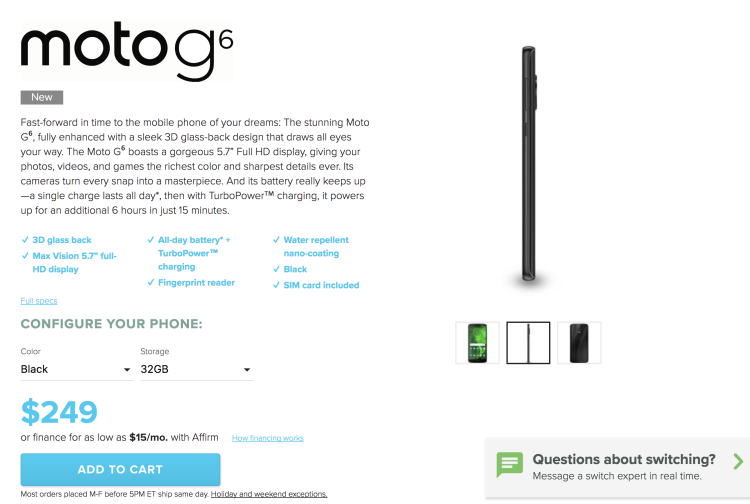

In late 2015, Republic found Affirm, which offers shoppers the flexibility to buy now and make simple monthly payments for their purchases. Affirm’s financing was a perfect match for the carrier’s goal to transcend the traditional role of a phone company—by serving as a phone community built on honesty and trust.

Since partnering with Affirm, Republic’s customers have the flexibility to get the phone they want now, and pick a loan that fits their budget. Motorola’s highly rated Moto G4 can now be purchased from Republic for $199 or as low as $11.95/mo with Affirm.* Similarly, the Samsung Galaxy S7 with 32 GB of memory can be purchased for $699 or as low as $41.98/mo with Affirm.**

Within weeks of offering Affirm’s flexible payments, about 6% of all phones sold on Republic’s website were financed, in line with Republic’s forecasts. Even more impressively, 10–20% of sales of top-of-the-line phones (priced at $600 or more) were financed through Affirm. This level of success “happened largely organically, as we spend only a small fraction of what our industry competitors spend on marketing & promotion,” said Vail.

Both Affirm and Republic leverage technology, innovation, and transparency to offer customer-centric solutions. Their partnership is great for customers— helping them afford cutting-edge devices and wireless service—and great for business—driving top-line revenue growth and other key metrics. Learn more about how Republic is using Affirm to succeed by visiting Republic’s site today!

*$11.95/mo based on the purchase price of $199.00 at 10% APR for 18 months. ++

**$41.98/mo based on the purchase price of $699.00 at 10% APR for 18 months.++

++ Subject to credit approval. Rates from 10-30% APR. Actual terms shown at checkout. Down payment may be required. For purchases under $100, limited payment options are available. Credit check required, though checking your eligibility won’t affect your credit score. Affirm loans are made by Cross River Bank, a New Jersey-chartered bank, Member FDIC.