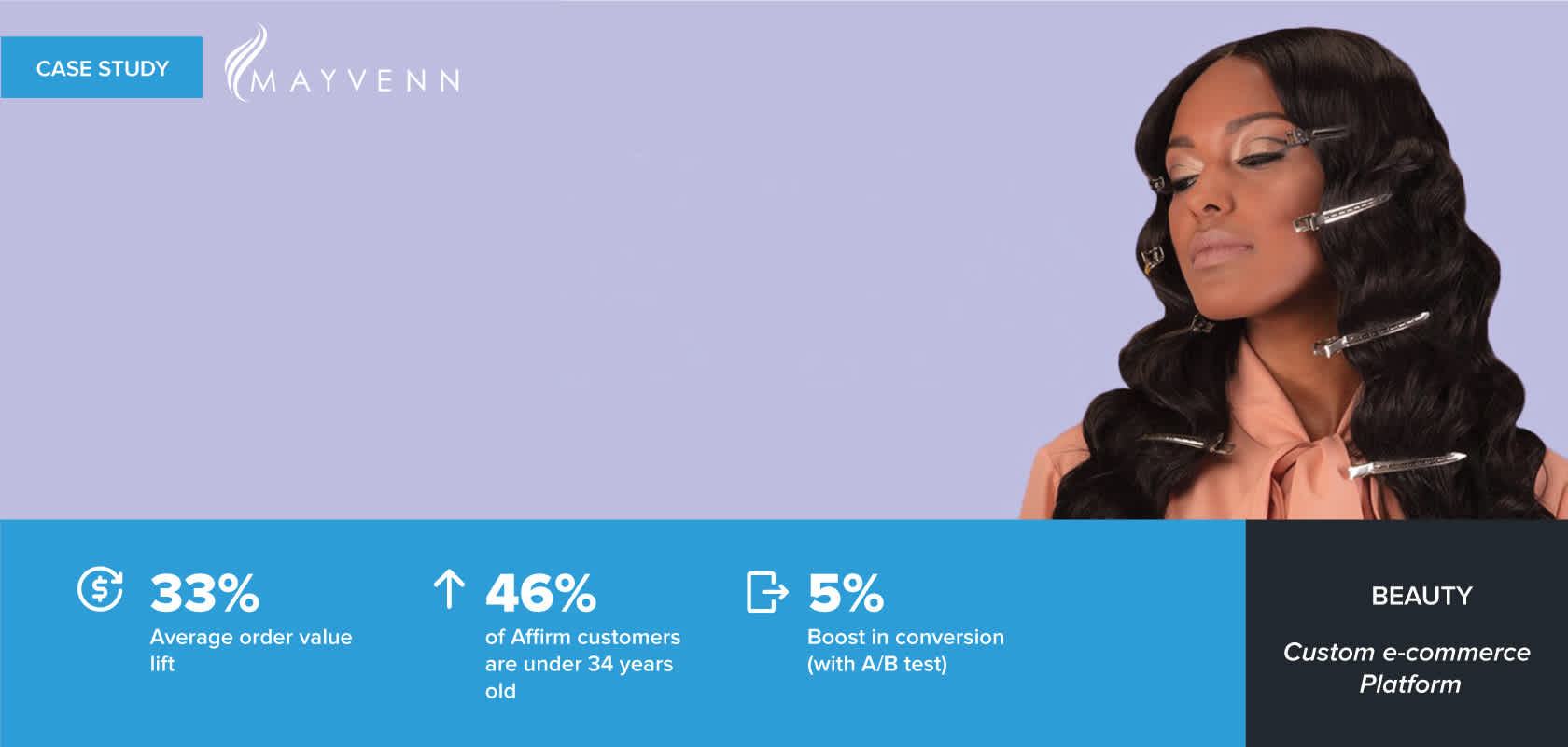

How Mayvenn Hair is using alternative payments to drive sales

Goal: Createhigherdemand for higher quality products by giving customers greater access to buy them.

Mayvenn helps hairstylists sell high-quality, virgin (never dyed) hair extensions directly to clients. The idea was born when Diishan Imira—Mayvenn CEO and founder— noticed an untapped opportunity in the hair extensions market. It was common for stylists to sell products like shampoo and hairspray directly to their clients, but they were referring clients to their local beauty supply shop for their extensions, losing out on a potential income source.

Mayvenn set out on a mission to help stylists grow their businesses. The e-commerce platform allows hair stylists to earn a commission on their extension sales, while Mayvenn takes on the heavy lifting on fulfillment, returns, and customer service.

Since launching in 2013, the platform has served over 100,000 stylists and hundreds of thousands of customers—translating into millions of dollars invested back into hair salons.

Greater product accessibility with alternative payment options

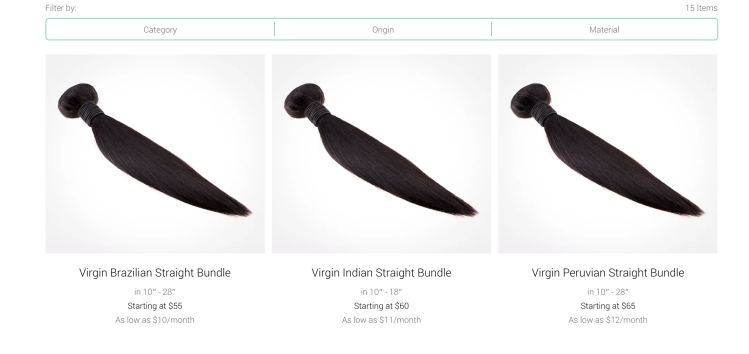

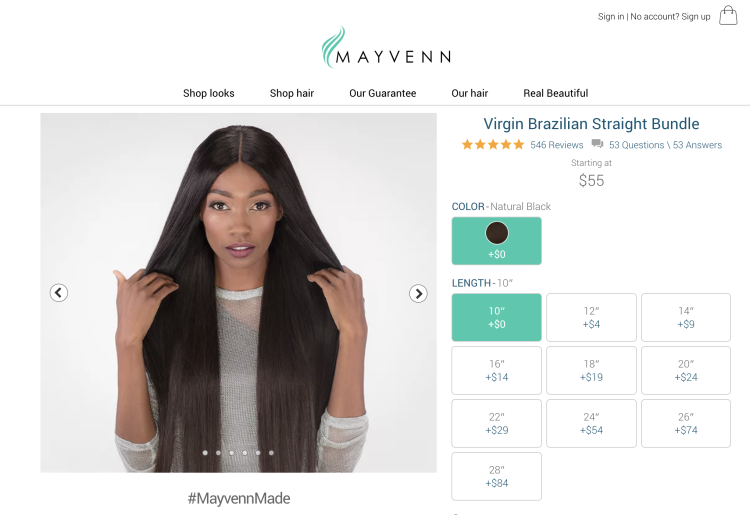

Offering virgin, 100% human hair, the superior quality of Mayvenn’s products tends to mean they err on the pricey side. When factoring in the frequency with which a regular customer needs new hair extensions, cost became a key concern for Mayvenn. It was important to the company to make its products accessible to consumers of all financial backgrounds. The didn’t want to sell lower-quality products made with synthetic hair, so instead they decided to keep their high quality product and instead offer an alternative payment, allowing customers to break up the expense over time. They found their ideal financing partner in Affirm, the honest financing company committed to clear, upfront pricing.

Beyond eliminating compounding interest and hidden fees from its lending practices, Affirm considers data beyond the traditional FICO score, enabling more responsible consumers to access credit. As Mayvenn’s customer base skews younger—and may not have built up a substantial credit history—this was a key advantage.

The company weighed Affirm against other financing options, including PayPal Credit, but “none of [the other options] gave us any confidence the outcome would be better than what Affirm gave us,” said Ryan Stevens, Mayvenn Product Manager. “Our customer base thus far has been limited to people who can afford our higher-priced products,” explained Stevens. “We wanted to make it more approachable to people that wanted the highest quality hair, but couldn’t afford the cost of it upfront.”

A boosted bottom line with Affirm

It was clear that Affirm’s customer-first values aligned well with Mayvenn’s own. Still, as a growing company whose business model hinges on its sophisticated technology, Mayvenn was hesitant to add Affirm into the mix without certainty the partnership would run smoothly.

In search of this assurance, Mayvenn launched a simple A/B test: half of its users were given the option to pay over time with Affirm, while the other half was not. The results clearly favored Affirm, with conversion rates spiking five percent when the financing option was presented.

The favorable data gave Mayvenn the confidence to fully launch Affirm. After a backend integration that Stevens described as seamless, financing options were introduced across the site. With the ability to break down purchases into manageable monthly installments, Mayvenn products became instantly more attainable.

The option to pay with Affirm also translated into a higher average order value. With spread out payments comes increased purchasing power, and customers found themselves able to buy more of their desired products all at once: Mayvenn saw a 33% AOV lift within thirty days. They’re also seeing a younger customer base—46 percent of those checking out with Affirm are under the age of 34. With Affirm, Mayvenn has discovered an innovative marketing opportunity.

They began incorporating Affirm’s “as low as” messaging into email blasts, community notifications, and social media campaigns— alerting customers of their products’ affordability upfront, thus encouraging both new and returning shoppers to buy. As Mayvenn looks to expand their product portfolio, maintaining a commitment to accessibility will be key. With Affirm’s flexible payment options, the company will continue to help more women access high-quality hair products, all while supporting their local stylists.