Late to holiday planning? Here's what shoppers want this year.

2020 has been a year of disrupted plans—including how retailers are approaching this holiday season. While some usually have their holiday game plan buttoned up by February, a recent survey found that over half of retailers had not started their preparations by August.

Fortunately there’s still time to get ready, and these insights—many from our consumer survey about holiday spending—can guide you toward healthy holiday sales.

Holiday shopping begins now

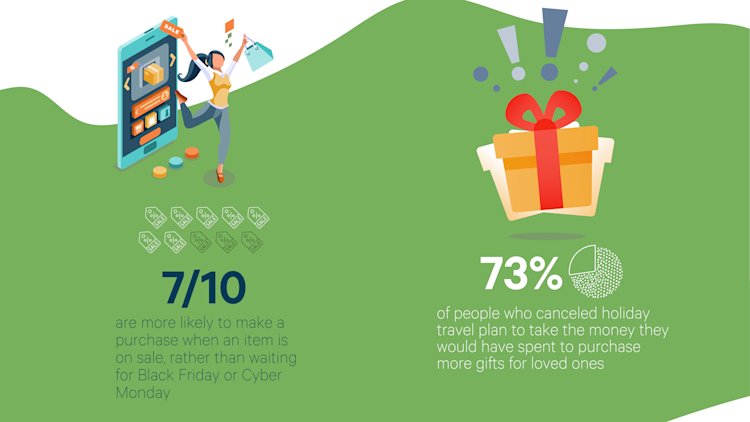

Don’t wait until after Halloween to start your holiday promotions. More than half of U.S. shoppers (56%) plan to begin their holiday buying earlier this year, with most starting in October. Early bird discounts can appeal to this segment of shoppers—especially since 67% of respondents agreed that if an item is on sale now, they’re more likely to buy it before Black Friday or Cyber Monday. (For more ideas, see this post about pulling purchases forward during the holiday season.)

Expect some pent-up demand

More than 4 in 10 Americans have canceled holiday travel, and 73% of them plan to use that money on gifts instead. Add in the personal savings-rate surge this year, and you may find a segment of customers feeling more generous at checkout than last year. This is an opportunity to recommend add-ons and complementary items to your customers throughout their shopping journey.

A mobile surge is coming

About half of shoppers (47%) plan to do the majority of their holiday shopping on mobile. Now is a good time to make sure your checkout flow—both online and in store—is as efficient and mobile-friendly as possible.

The mobile surge is also expected to be part of an explosion in online holiday shopping. Stress-test your site soon to make sure you’ll be able to handle the spike. This is especially important for Thanksgiving Day, as more stores choose to close on this usually busy shopping day. Retail analysts predict that Thanksgiving weekend online sales will break records, so you’ll want to be ready to process a high volume of digital orders.

Customers want payment flexibility

Many shoppers are stretching their budgets this year due to economic uncertainty. Giving them the option to buy now and pay later (BNPL) can help: Our survey found 42% of people are interested in using a pay-over-time option for buying holiday gifts this year. What’s more, if an item they want to buy is only available at full price, 38% of shoppers are more likely to still make the purchase if a BNPL option is available.

Remember: Not all pay-over-time options are equal. Nearly half of shoppers (48%) said they’re interested in using BNPL but are worried about hidden fees. Affirm charges no hidden or late fees, and retailers who partner with us to offer BNPL solutions can be sure their customers won’t unwrap an unpleasant surprise later.

Lean in to your brand values

With all that’s happened this year, many people are looking to help others—whether it’s part of their holiday spirit or a desire to relieve hardships from the pandemic and natural disasters. Why not share with your customers any mission-driven activities you’re engaged in? Shoppers want to know how your business is taking care of employees, for example, and how you’re committed to being a good citizen in the community. Be transparent about your efforts as part of your holiday marketing and social media presence—it just might bring you a holiday bonus in the form of customer retention.

Holiday sales volume determines success for many retailers, and it’s especially true this year. We hope these insights help with planning so that your holiday sales activity is worthy of the year’s most overused word—unprecedented!

Learn more about how Affirm can increase sales for your businessthis holiday season, and see our infographic for more insights about consumer holiday spending plans.

NOTE: The survey was conducted by OnePoll for Affirm from Aug. 27-Sept. 2, 2020, with a sample of 2,000 Americans.