Affirm is driving customer loyalty for Garmentory

Goal: Increase conversions while establishing long-term relationships, all while improving the customer purchasing experience.

Many people are entirely happy with dressing in mass-produced clothing they buy at big-box retailers – dubbed fast fashion – through online marketplaces or their favorite old-school department store.

Many others, however, are constantly on the hunt for something different. They want the unique, contemporary, and emerging fashions that will make them stand out from the crowd and express their personal sense of style.

For consumers that are part of that latter social movement who prefer to buy fewer, nicer, higher quality clothing items, Garmentory is already at the top of their shopping list. An online platform and mobile site,

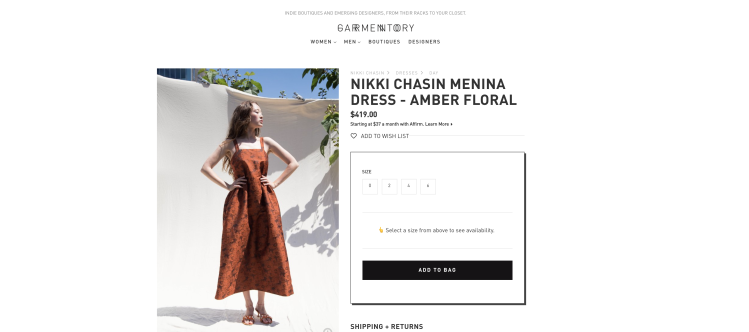

Garmentory connects shoppers all over the globe to boutique brands, emerging designers, and specialty retailers that may only have limited physical locations.

Payments are a big part of the customer relationship

The Seattle-based company obsesses over photos and editorial content to ensure a high-touch shopping experience for the curated and coveted shoes and shirts, bags and belts, tops and bottoms – even an eclectic selection of lifestyle gems – offered on the site.

And payments, Garmentory CEO John Scrofano, realized is a legitimate, significant part of the company’s package.

“Payments may be the last interaction of the shopping process, but it’s definitely not the end of the customer relationship,” said Scrofano, who wanted a fair and honest option beyond credit cards and PayPal that would open an additional opportunity for shoppers to create that relationship with Garmentory and their marketplace of boutiques and designers.

In keeping with Garmentory’s curated approach to all things UX, it wasn’t about offering 25 different payment methods, but rather about finding the few that fit with their established brand identity.

Affirm is propelling both sales and customer retention

“Whatever we chose had to be simple,” said Scrofano. “We wanted three – credit cards, PayPal, mainly because Europeans love it, and something else. Just enough to appeal to all the needs of our customers, but not clutter up the site, and Affirm fit the bill.”

But Affirm’s simple interest, pay-over-time installment loans that don’t charge hidden fees of any kind, turned out to be much more than just a payment alternative to traditional revolving credit products that charge compounding interest and often come with predatory fees. For many of Garmentory’s customers, credit cards aren’t a great solution for those buying fewer, yet higher quality, items. Instead, Affirm has been the solution that unlocked the ability for these customers to buy and, just as important, keeps them coming back.

The broader impact of adding Affirm was nearly instant for Garmentory. Credit approvals through Affirm are triple what they are via traditional credit, opening up a whole new customer base, especially millennials. Average order values (AOV) also increased by 60 percent.

Better yet for Garmentory, who are hyper-focused on customer loyalty and experience, 50 percent of shoppers who financed their purchases with Affirm came back to buy again, outpacing the other site-wide visitors many times over.

“And all with zero risks to us, since Affirm pays us in full at the time of settlement, and takes full responsibility for any fraud or default,” said Scrofano.

But what most surprised Scrofano were the net promoter score surveys that Garmentory sends out after every purchase to understand what’s working and not for his customers.

“No one ever used to mention payments,” he said. “But there’s now a large group of customers who are so glad to have Affirm, that they write it into the comments. It’s amazing.”