An inside look into Affirm financing program optimization

While simply offering an alternative payment method can have a significant impact on your business, here at Affirm we go above and beyond to make sure your business gets the most out of your financing programs.

Our goal is to provide our merchant partners maximum benefit—in the form of incremental revenue. One way we do this is by creating personalized financing programs for our partners based on their specific business model. This could be based on anything from their product offerings and cart sizes to the customers they want to attract.

Here’s an example of how we’re working with our merchant partners to create financing programs tailored specifically for their business goals.

Understanding the business goals

Merchant X* wanted to customize their financing programs and personalize what they could offer their customers. They had been focused on hyper-growth for some time but now wanted to re-allocate spending on the programs that were driving the highest impact for their business. The products the merchant was offering had changed and evolved since they first launched with Affirm, so they wanted to ensure their financing offerings still made sense given their new breadth of products.

Our analytics team dove into the data and extracted valuable insights about Merchant X’s customer behavior. Armed with this information, we created multiple financing programs that addressed Merchant X’s goal to gain real incremental value from their financing offerings.

We created the financing programs based on their shopper’s unique characteristics, the merchant's product offerings, and more in order to address their business goals. Once we found the ideal financing program that would achieve those goals, we coded the most appropriate offering to be delivered dynamically—without any additional development work from the merchant.

*We have disguised the identity and data of this merchant for their privacy, but it is representative of the true merchant’s experience.

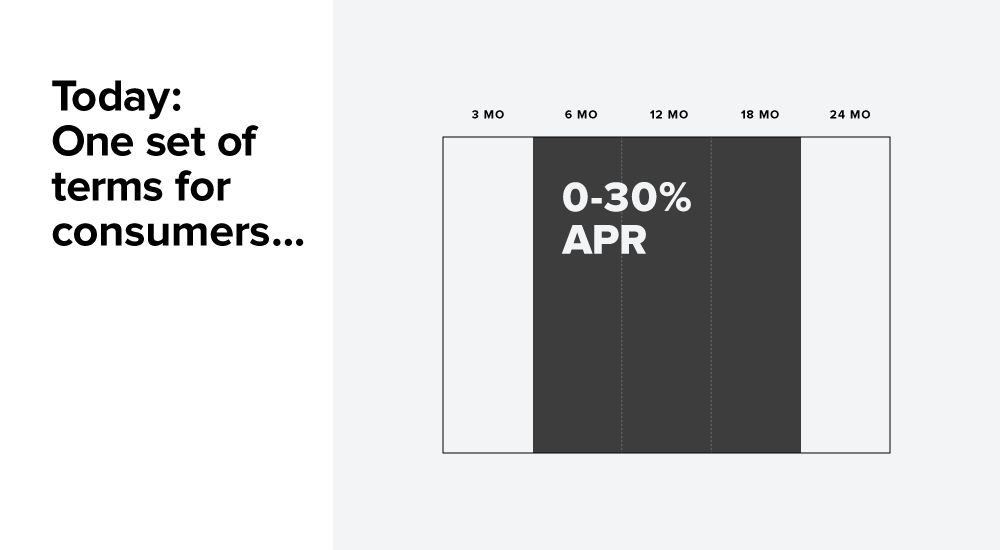

Original offering was one-size-fits-all

Merchant X first began offering Affirm with a single financing program for all cart sizes.But under the first iteration of Affirm’s program, all of Merchant X’s shoppers—as long as they were approved for financing—were presented with same 6, 12, or 18-month repayment terms with APRs between 0-30 percent.

Almost immediately, the merchant saw that they were reaching new customers with Affirm. They were excited about Affirm’s impact and soon Affirm became an integral part of their business. But as they entered a new phase of their growing business, the company wanted to optimize their financing offering while maintaining their margin structure. They asked us if we were able to create new, multiple financing programs to help them meet this goal while maintaining their strong volume.

A deep dive into merchant data revealed points for optimization

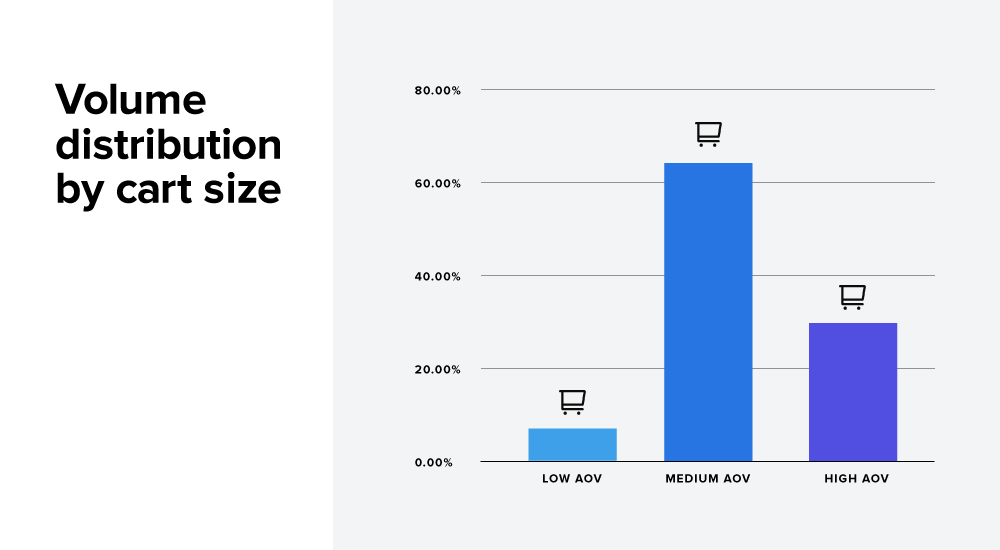

Affirm wanted to give Merchant X the most optimized offering by finding the perfect balance between cost and the incremental revenue they receive. Our team’s analysis of Merchant X’s Affirm purchases revealed a natural clustering of cart sizes:

1. Low average order value (AOV) cart size

2. Medium average order value (AOV) cart size

3. Large average order value (AOV) cart size

Our team saw that around five percent of loans were for low AOV carts. About two-thirds were between medium cart sizes, and 30 percent were for large, high-value carts. Each cart size cluster had distinct purchasing behaviors.

Affirm created customized financing programs

We decided to create three custom financing programs—one for each cart size segment—based on specific buying behaviors of those shoppers. We looked at data sources including:

1. Merchant X’s own historical data

2. Data from merchants in similar industries

3. Consumer purchasing behavior across all industries

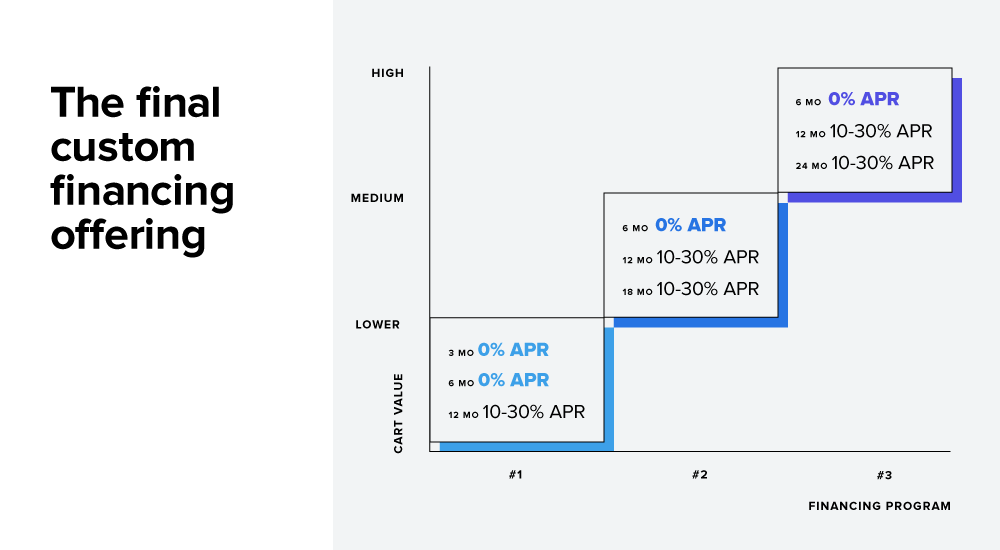

We were able to adjust our offering to remove high-cost offerings that weren’t providing enough additional value and expand loan volume by implementing new more appropriate terms for specific cart sizes. We were able to develop three optimized financing programs that would increase their gross profit.

Each financing program is described below.

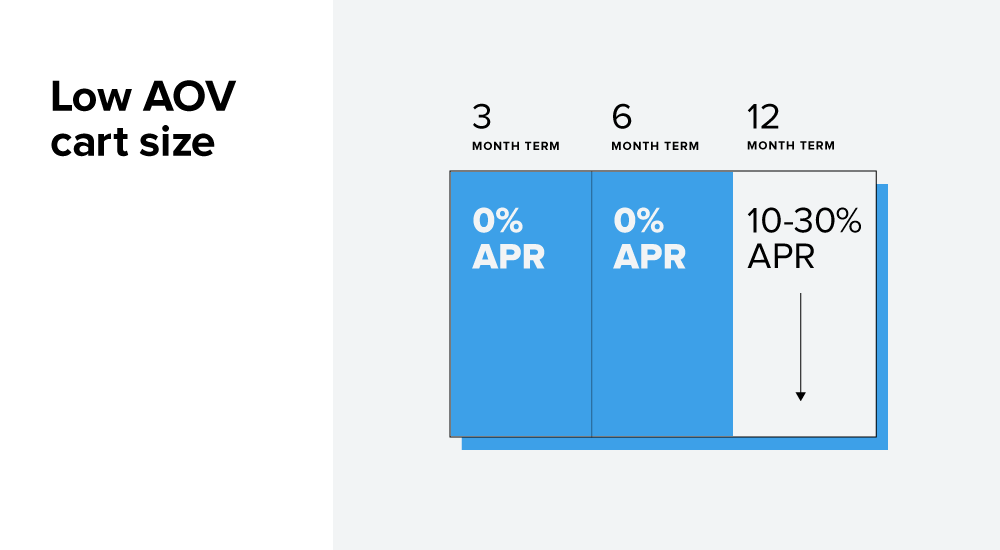

Low AOV cart sizes

Here, we revamped the payment period to fit a less expensive basket size. Three months was an attractive term-length for shoppers with lower cart values but required a 0% APR promotion to sway them to follow through with Affirm. We suggested offering as low as 0% APR on 3-month and 6-month terms in order to convert these shoppers.

We also saw that we could remove the high-cost 18-month repayment period. Shoppers who choose 18 months at this lower price point were just as willing to commit to the cheaper 12-month, interest-bearing repayment period.

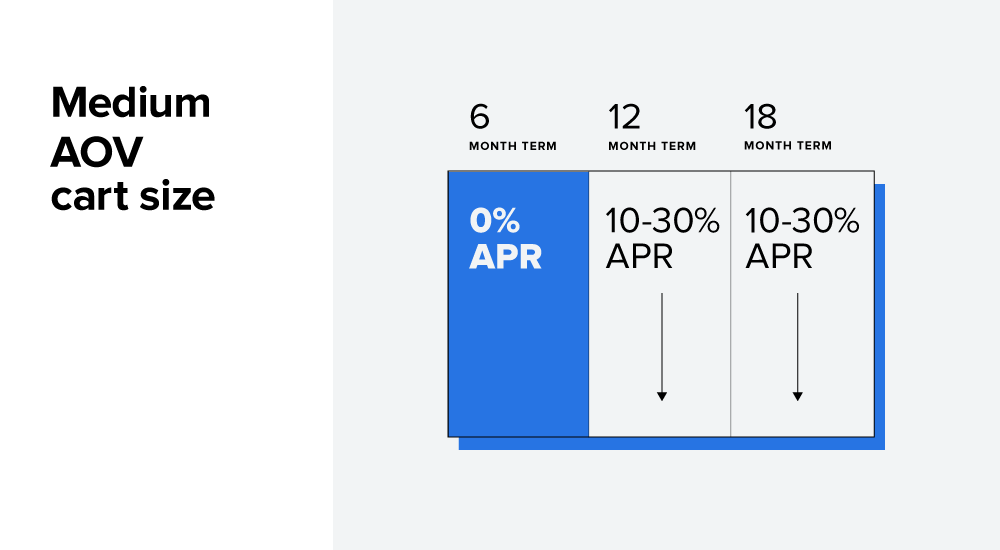

Medium AOV cart sizes

Here, we decided to offer as low as 0% APR to shoppers who chose a 6-month repayment term to entice them to complete their payment with Affirm. We removed the expensive three-month, 0% APR repayment option and added an 18-month term to ease the burden of these larger purchases on shoppers but continued with interest-bearing loan terms for these longer periods to balance risk.

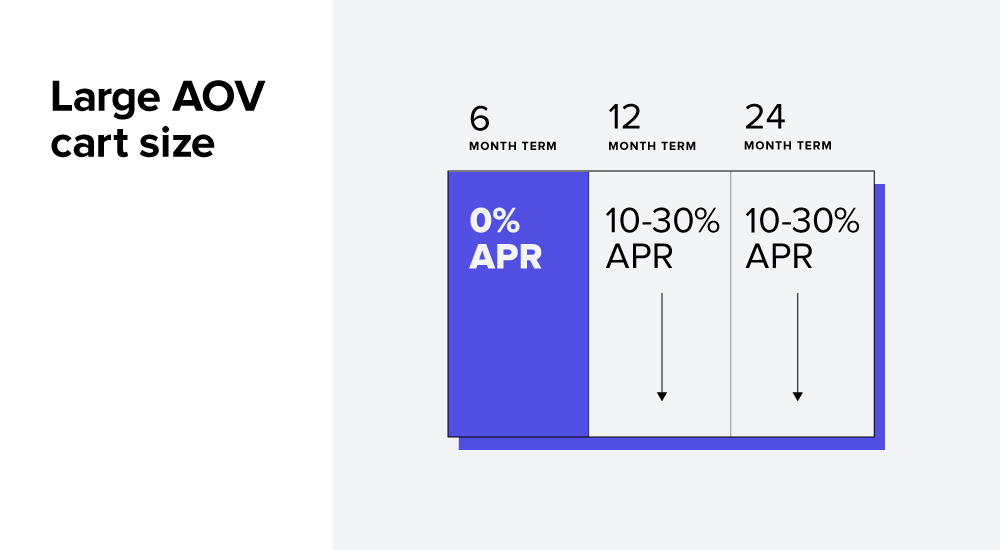

Large AOV cart sizes

For the expensive carts, we kept the same structure as the medium AOV cart sizes but replaced the 18-month plan with a 24-month repayment schedule to lower monthly payments even further for their customers. This plan would help more budget-conscious shoppers to complete their purchase and thus increased their loan volume in this segment. Here the extra cost of longer terms was offset by the dramatic increase in loan take-up rate. We continued to offer as low as 0% APR on 6-month repayment terms.

Affirm cut costs—but not loan volume

These customized financing programs resulted in a 17 percent increase in gross profit annually. We did this by both increasing loan volume and by replacing high-cost programs that weren’t resonating with their customer with new, more attractive payment terms. For Merchant X, this money could now be invested in other ways, like hiring more employees and investing in their products.

We have introduced a new feature in order to do this type of customization faster and with more detail—Enhanced Analytics. By implementing this feature you will get deeper insights into your business and be able to continually optimize your financing programs to fit your customer base. Once Enhanced Analytics is in place, there is no backend work for you. We can create programs that will boost revenue, capture more shoppers, or achieve any other goal you have efficiently and easily.

Contact your client success manager or reach out the merchanthelp@affirm.com if you are interested.