Big Chill is brightening kitchens with Affirm

Goal: Improve appliance affordability and reach new customers with flexible payment options

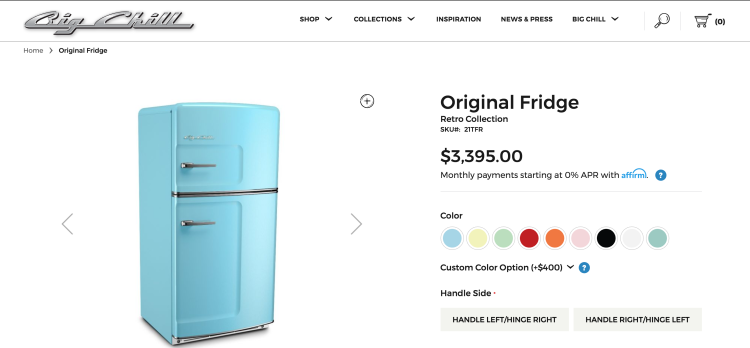

Big Chill was started in 2001, when Thom Vernon sought a 50’s-inspired refrigerator for his vintage beach house, but didn’t want the old-school, energy-sucking performance that a period piece would bring. Recognizing a gap in the marketplace, Orion Creamer— Vernon’s nephew and a recent product design school graduate—set out to build a fridge that would be both funky and functional.

The demand was instant. It wasn’t long before Big Chill expanded into dishwashers, ovens, and stoves, and launched several design lines to further grow their selection.

Chris Kawaja, an owner at Big Chill, says their customers include the recent home-buyer who’s intent on designing their dream kitchen, as well as designers, architects, and builders who are tired of stainless steel and appreciate the appliances’ unique designs. Rachael Ray, Miranda Lambert, and Patrick Dempsey are also among the growing list of celebrities whose kitchens rock Big Chill’s signature flair.

People clearly desire Big Chill’s products but kitchen appliances are, by nature, quite pricey. So when consumers began requesting flexible payment options to make these big-ticket purchases more manageable, the company was quick to accommodate.

Pay-over-time to target new customers and bring back cart abandoners

For Big Chill, adding financing options made sense, both logically and strategically. Kawaja noted that consumers regularly finance cars whose lifespans are far shorter than that of a kitchen appliance. Why shouldn’t they be able to finance their appliances as well?

Big Chill sought a branded solution—a financing partner whose terms were simple, and who would provide a positive customer experience. Enter Affirm: the modern pay-over-time financing company with a mission to make the banking industry more honest. Affirm enables customers to pay for their Big Chill appliances in 3, 6, 12, or 18-month installments—free of compounding interest. And by considering data beyond the FICO score, Affirm is able to provide responsible credit to a broader consumer pool than is reached by traditional credit.

A relationship that Big Chill sought simply to meet a customer demand turned into a powerful marketing and strategy tool. By leveraging “as low as” messaging, Big Chill found that with Affirm, they could effectively communicate their products’ affordability. And by broadcasting the option to spread out payments via display ads, social media, and email newsletters, Big Chill discovered that Affirm was an innovative means to target new customers, and bring back cart abandoners.

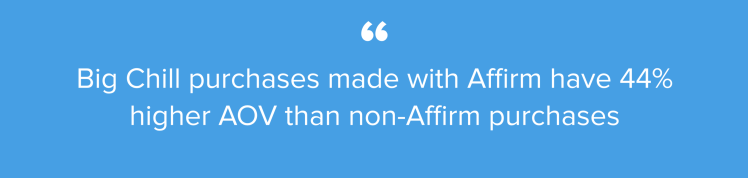

Flexible payment options drive higher average order values

Since adding financing options to its site, Big Chill has seen substantial boosts in average order values: Big Chill purchases made with Affirm have a 44% higher AOV than non-Affirm purchases.

The option to spread out payments is giving customers the purchasing power to buy an entire kitchen set, when they may have otherwise checked out with a single appliance.

The impact of Affirm was amplified when Big Chill ran a 0% APR promotion. An already sizeable AOV lift jumped an additional 20%. Moreover, Affirm’s share of cart doubled, as an even greater proportion of Big Chill shoppers was compelled to take advantage of financing options.

At the core of Big Chill’s business is a mission to make everyday objects more beautiful and fun. By implementing flexible payment options, Big Chill opened up their products to a considerably larger customer base. The result is greater accessibility of the bold appliances that bring color to people’s homes and lives.